risks associated with closed end funds

As investor interest in closed-end funds increases as people search for. Get this must-read guide if you are considering investing in mutual funds.

Difference Between Open Ended And Closed Ended Mutual Funds

Risk in closed-end funds.

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

. When I talk to investors I often find that one of the most misunderstood investments is Closed-end Funds CEFs. This UIT is a buy and hold strategy and investors should consider their ability to hold the trust until maturity. There are varying levels of risks associated with each closed end fund.

Each closed end fund has a different amount of. Closed-end funds CEFs can be one solution with yields averaging 673. The problem is they can be mistaken for mutual funds or exchange-traded funds ETFs because they also hold a.

Prices might fluctuate from a high to a low value point in a single days trading activity. It can also increase risk and can make the price of closed-end fund shares more volatile. The single biggest risk in ETFs is market risk.

Closed-end fund definition. Changes in interest rate levels can directly impact income generated by. Prices may swing from one high value to a low value point all in one days trading action.

A closed-end fund or CEF is an investment company that is managed by an investment firm. Similar to open-end funds closed-end funds are just as susceptible to market fluctuations and volatility. Their yields range from 632 on average for bond CEFs to.

Closed-end fund shares may frequently trade at a discount or premium to their net asset value NAV. There may be tax consequences unless units are purchased in an IRA or other qualified plan. While investors basically understand the ins and outs of mutual funds thats not true for CEFs.

Closed-end funds may use debt or other leverage more than other types of investment companies to purchase their investments. For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry. A closed-end bond fund is a popular type of investment as it is a convenient and affordable way to increase income.

This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and ability to make distributions to shareholders. All bond closed-end funds are subject to some degree of market risk and credit risk. This can be a retail product for those who can stomach the associated risks in their search for relatively high-potential income and gains.

Buy Hold Risk Taxable Trusts. Like a mutual fund or a closed-end fund ETFs are only an investment vehiclea wrapper for their underlying investment. So if you buy an SP 500 ETF and the SP 500 goes down 50 nothing about how cheap tax efficient or transparent an ETF is will help you.

Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage. Market risk is the risk that interest rates will rise lowering the value of bonds held in the funds portfolio. Just like open-ended funds closed-end funds are subject to market movements and volatility.

Like any investment product closed-end funds come with a range of risks which well cover next. It can offer many benefits from low share. In secondary markets closed end fund shares are frequently accompanied by considerable trading volatility.

Ad Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals. Closed-end funds use of leverage can increase your returns but can also increase your losses. Principal loss is possible.

Credit Risk Credit risk is the risk that the issuer of a security will default or unable to meet its obligations to pay interest or principal as scheduled. Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers. Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds.

Investing in closed-end funds involves risks. Market Risk Of Capital Loss. One definite advantage that closed-end funds offer is access to specialized assets such as junk bonds or bank loans.

Ad Invesco has long been at the forefront of innovation in the ESG space. Closed-end funds are build like a mutual fund but trade like a stock. Shares of closed end funds in secondary markets are often accompanied by high volatility in trading.

At year-end 2021 assets in bond closed-end funds were 186 billion or 60 percent of closed-end fund assets. Closed-end funds can offer advisers opportunities to. Diversified by asset strategy manager.

Investors should take a careful look at the closed-end bond fund option when looking to diversify their portfolio. Closed-end funds provide exchange-traded flexibility income potential ability to tap into specialized asset classes and lower investment minimums. Because closed-end funds can trade at discounts or premiums to net asset value they are more volatile than the equivalent open-end fund says advisor and money manager Leland Faust author of.

Answer 1 of 2. Judge a book by its cover risk. What are the risks associated with Closed-end Funds.

Shares of a closed-end fund may trade above a premium or below a discount the NAV of the fund. Exposure to Leverage or Debt. Risks Securities in a portfolio of a closed-end fund may decline in value and the closed-end fund may not.

Like a traditional open-end mutual fund a closed-end fund is a professionally managed investment company that pools investors capital and invests in stocks bonds or other securities according. What are the risks associated with Closed-end Funds. Closed-end funds are subject to various risks including managements ability to.

There is no guarantee a funds investment objective will be achieved. The value of a. Ad Learn why mutual funds may not be tailored to meet your retirement needs.

Just like open-ended funds closed-end funds are subject to market movements and volatility. Trading in such portfolios requires research and analysis before such investment. Many mutual funds invest in junk bonds but when you add a discount and.

If you have invested in a closed-end fund CEF or with any broker financial adviser or firm whose solicitation or advisement to invest in a CEF has proven harmful to your investments or interestsfor instance by introducing significant risk that has proven costly into a portfolio with a stated low level of risk toleranceplease call The Law Offices of Jonathan W. Access ESG-focused ETFs with strategies that align with your values. What this means for you.

Closed-end funds raise a certain amount of money through an initial public.

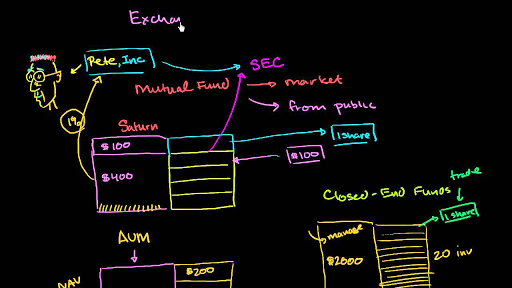

Understanding Closed End Vs Open End Funds What S The Difference

Rr Investors Offers Uti Capital Protection A Close Ended Capital Protection Oriented Income Fund Mutuals Funds Investing Fund

What Is A Closed End Fund And Should You Invest In One Nerdwallet

5 Best High Yielding Closed End Funds To Buy

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Birla Sun Life Emerging Leaders Fund Series 3 Let Your Ambitions Soar Higher With Us High Potential Discovered Early A Closed E Investing Mutuals Funds Fund

What Are Closed End Funds Fidelity

Difference Between Open Ended Funds Vs Close Ended Funds

Capital Protection Oriented And Dual Advantage Mutual Funds Mutuals Funds Investing Fund

What Are Closed End Funds Fidelity

Exchange Traded Funds Etfs Video Khan Academy

Pin On Investing In Mutual Funds

5 Best High Yielding Closed End Funds To Buy

With All The Possible Dividend Investments Out There I Thought I Would Show A Sample Cef Dividend Mutual Funds Investing Dividend Investing Finance Investing

/155571944-5bfc2b9646e0fb005144dd3f.jpg)

:max_bytes(150000):strip_icc()/mutual-funds-lrg-5bfc2b204cedfd0026c10488.jpg)

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2f4b46e0fb00260bd35d.jpg)

:max_bytes(150000):strip_icc()/GettyImages-172204552-a982befe78f94122afee99916a7a4704.jpg)